Installment payments are meant to simplify repayment. In practice, they often introduce hidden complexity. When interest applies across multiple installments, even small calculation or posting errors can compound over time. The result is balance drift, disputes, and reconciliation issues that surface late and are costly to fix.

In installment-heavy models such as Buy Now, Pay Later, research shows that 41% of users have made at least one late payment. Many of these payments are only slightly delayed. Even minor timing shifts make accurate interest application harder without automation.

This is where approach matters. Automated interest application on installment payments is less about speed and more about precision and consistency. In this article, we explain how to approach interest automation correctly, when it is truly needed, and how to avoid common execution pitfalls.

Brief look:

Automated interest application uses system‑driven rules to calculate and apply interest as installment payments are made. Instead of relying on manual updates or periodic adjustments, interest is consistently applied based on defined rates, schedules, and outstanding balances.

When an account enters an installment plan, collections teams depend on accurate, real‑time balances to post payments correctly, communicate amounts owed, and prevent disputes. If interest continues to accrue during the repayment period, automation ensures balances reflect reality rather than outdated assumptions.

This approach is most critical in repayment models where balances shift over time and precision directly impacts recovery outcomes. The next section explores the types of loans where automated interest is commonly applied.

Suggested Read: Understanding Interest-Bearing Payment Plans in Debt Recovery

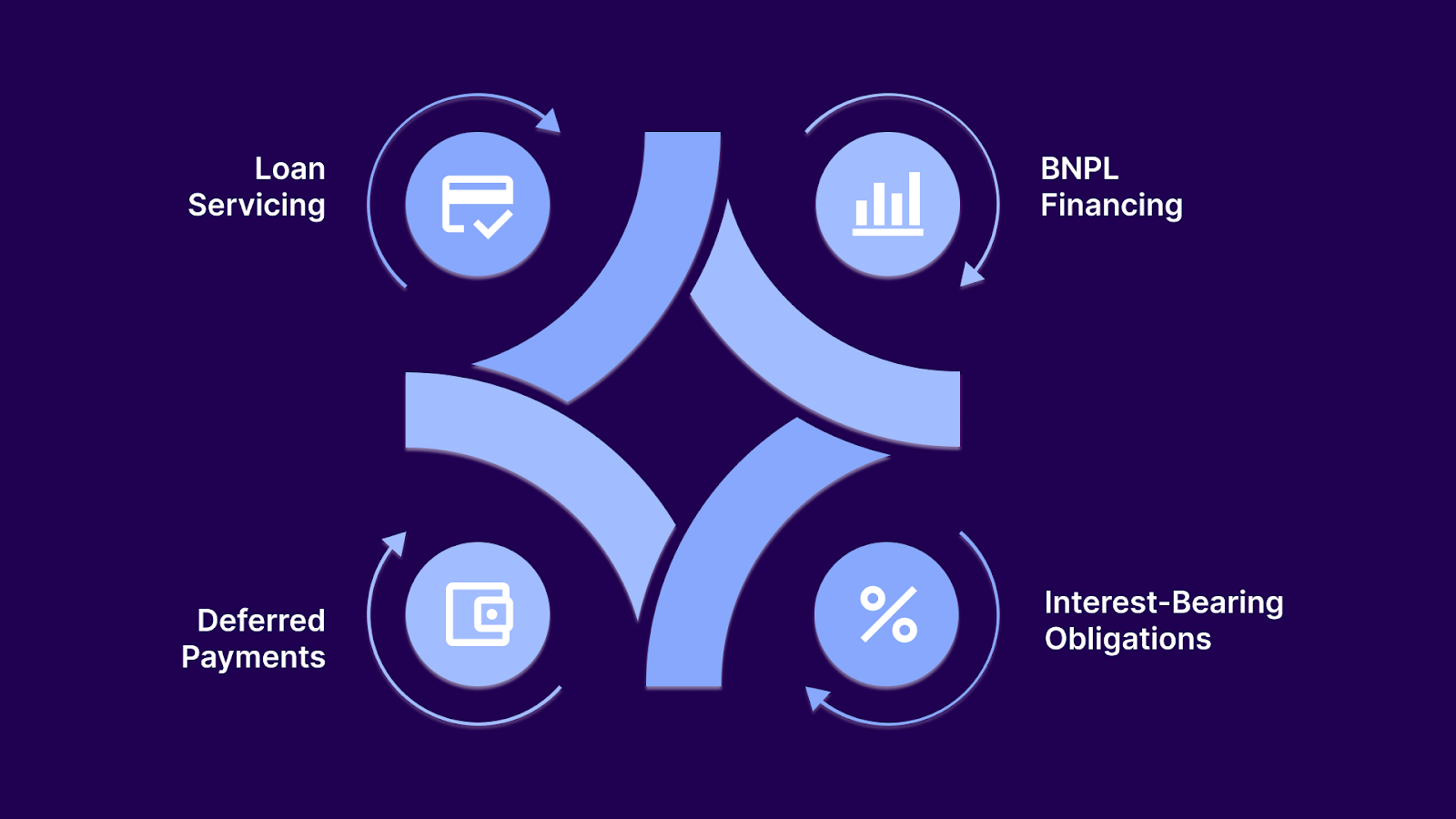

Automated interest application is most effective in repayment models where balances evolve over time and accuracy must be preserved across many scheduled payments.

These environments depend on system-driven rules to keep balances current when payment timing, amounts, or plan terms change. The objective is consistent, auditable treatment of interest at scale.

It is typically used in:

The next section explains how automated interest application works in practice, and what actually happens when systems apply interest across installment payments.

Suggested Read: 6 Proven Digital Collections Strategies to Recover More Debt

Instead of relying on manual recalculation or periodic adjustments, systems follow a consistent logic that governs when interest applies, how it is allocated, and how balances are updated.

This becomes especially important when installment plans run over longer periods and payment behavior is not perfectly linear. In practice, it typically involves:

Tratta helps by synchronizing updated balances from upstream systems and executing installment payments against interest-bearing amounts accurately. This ensures posting, schedules, and consumer-facing balances remain consistent throughout the life of the installment plan. Learn more by scheduling a demo.

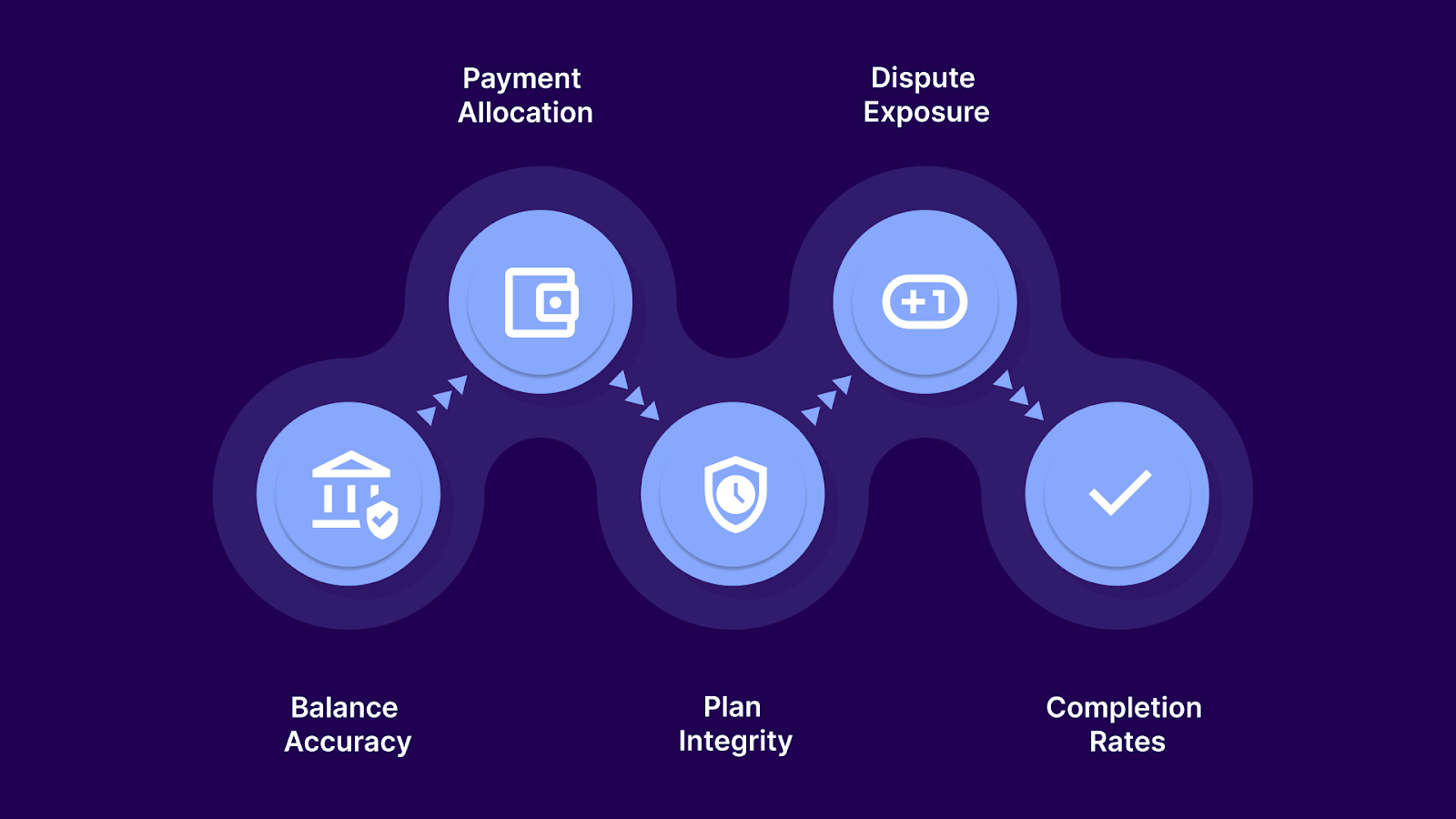

Installment payments shift collections from one-time recovery to ongoing execution. Once accounts enter payment plans, agencies are responsible for managing balance accuracy over time, not just securing an initial commitment. When interest is involved, small execution gaps can quickly turn into disputes or broken plans.

Installment payments require agencies to pay close attention to:

These operational pressures make interest automation a high-impact area for error if not handled carefully. The next section looks at the difference between interest accrual and payment execution.

Suggested Read: How to Settle Accounts Quickly and Effectively

In installment-based repayment, interest accrual and payment execution influence the same balance but operate in very different ways.

The distinction matters because teams are responsible for execution accuracy, even when calculations are performed elsewhere. Confusing the two is where balance errors and disputes often begin.

Table showing how interest accrual and payment execution differ:

These functions usually live in separate systems because they serve different operational goals. Interest accrual requires financial and regulatory logic, while payment execution focuses on scheduling, posting, reconciliation, and communication. That separation is normal, but it makes synchronization critical once accounts move into installment plans.

Common failure points when the two fall out of sync:

Recognizing this divide helps in managing balance changes over multi-installment plans. This is explained in the next section.

Suggested Read: How to Handle Debt in Collections: Strategies for Agencies

Multi-installment plans introduce ongoing balance movement that extends well beyond the first payment. Interest accrual, payment timing, partial payments, and plan adjustments all affect the amount owed over time. Without clear handling, these changes create confusion for teams and consumers alike.

This is how you can handle different types of balance changes:

Interest can continue to accrue while an installment plan is active, shifting the outstanding balance from one payment to the next. These changes are often incremental, which makes them easy to overlook but impactful over the long term. Accurate tracking ensures that each installment reflects the exact amount owed at that time.

To manage this effectively:

Late or partial payments disrupt the expected installment schedule. When this happens, balances may change, affecting future installments and payoff timelines. If not handled correctly, these adjustments can cascade into disputes or broken plans.

To manage this effectively:

Installment plans are sometimes modified mid-cycle due to hardship, renegotiation, or settlement adjustments. These changes often require recalculating remaining balances while preserving payment history. Poor handling at this stage increases the risk of errors.

To manage this effectively:

Balance changes often originate in one system and are executed in another. Delays or gaps in synchronization are a common source of errors during long-running installment plans. Visibility is critical to maintaining trust and execution accuracy.

To manage this effectively:

Tratta syncs updated balances through secure API and SFTP integrations and reflects changes immediately in its reporting dashboards. This keeps installment payments, posting, and balance visibility aligned throughout long-running plans.

Interest-bearing installment plans increase compliance exposure because balances change over time rather than remaining fixed at the time of placement. Each balance update affects disclosures, payment posting, and consumer communications, all of which are regulated touchpoints.

Even when interest is calculated upstream, agencies are accountable for how those balances are presented and enforced during collections.

Interest-bearing installments introduce risk in several areas:

These risks are rarely the result of intent. They arise from timing gaps, system mismatches, and manual handling of balance updates. These are explained in the next section.

Interest automation in payment plans introduces complexity because agencies sit downstream from interest calculation but upstream from consumer communication and execution.

Common challenges agencies face include:

Agencies that manage interest-bearing installment plans need to focus on execution discipline, synchronization, and transparency rather than calculating interest themselves.

Suggested Read: Key Skills for Modern Debt Collection Agents Using Digital Tools

Tratta is a digital-first collections platform built to execute payment plans accurately once balances exist, including those that change due to interest or fees applied upstream.

The platform does not calculate interest itself. Instead, it ensures that installment payments, posting, disclosures, and reporting stay aligned with the most current balances throughout the life of a plan. This makes it especially relevant when interest-bearing installment payments are sent to collections.

These features directly support accurate execution:

Tratta uses updated balances through secure APIs and SFTP file transfers. This allows interest-adjusted balances from creditors or servicing systems to sync into Tratta without manual intervention. As a result, installment execution always reflects the latest amount owed.

Consumers can view balances, make payments, or manage installment plans through Tratta’s self-service portal. Because balances are synced upstream, what consumers see aligns with interest-adjusted amounts. This reduces confusion and disputes during long-running plans.

Tratta supports structured installment plans with scheduled payments. Once a plan is active, payments are executed against current balances rather than static totals. This is critical when interest continues to affect the outstanding amount during repayment.

Payments are monitored and posted automatically as they occur. If balances change due to interest updates, Tratta applies payments accurately without requiring rework. This keeps installment schedules intact even when timing or amounts vary.

Tratta supports digital communications across SMS, email, voice, and portal notifications. Messaging reflects current balances rather than outdated figures, which is especially important when interest rates change mid-plan.

Rule-based workflows ensure that installment activity continues even when conditions change. You can automate follow-ups, reminders, or escalations based on payment behavior without breaking compliance or execution accuracy.

Tratta provides real-time reporting on payments, balances, and plan performance. When interest-bearing balances shift, reporting reflects those changes immediately. This gives teams visibility into plan health without waiting for reconciliation cycles.

Tratta is PCI DSS Level 1 compliant and tokenizes sensitive payment data. This ensures that installment payments, including those tied to interest-bearing balances, are executed securely without exposing agencies to unnecessary risk.

Interest-bearing installment payments increase execution risk because balances change over time. Tratta addresses this by acting as a reliable execution layer that keeps payments, posting, visibility, and compliance aligned with upstream balance changes.

Automated interest application on installment payments is ultimately about control and accuracy over time. When balances change across multiple payments, even small gaps between calculations, postings, and communications can create disputes, compliance exposure, and broken plans.

Tratta is built to execute interest-bearing payment plans accurately by syncing updated balances from upstream systems and applying payments, disclosures, and reporting consistently throughout the plan lifecycle. By focusing on execution rather than calculation, Tratta helps agencies manage complexity without introducing new risk.

If your agency manages installment payments where balances change over time, execution accuracy matters. See how Tratta supports interest-bearing payment plans without manual workarounds. Speak to our team today.

Yes. When interest is applied during repayment, disclosures must accurately reflect changing balances. Agencies must ensure that statements, portals, and communications remain consistent with the current amount owed to avoid confusion or regulatory issues.

There is no single standard. Best practice is to sync balances frequently enough to ensure payments are always applied to the most current amount, especially before posting installments or generating consumer-facing views.

They can, but only if the balance history, payment activity, and remaining terms are preserved. Poor data handoffs are a common source of balance drift and disputes when interest-bearing plans move between platforms.

Changes typically need to be applied prospectively, not retroactively. Clear documentation and transparent balance updates are critical to prevent disputes and ensure compliance.

Yes. Longer timelines and evolving balances increase audit complexity. Agencies benefit from systems that maintain detailed records of balance changes, payments, and timing across the entire life of the plan.